Blog Layout

Understanding SBA Emergency Loans

Forward Law • Apr 07, 2020

Understanding SBA Emergency Loans

Business owners around the country are struggling with questions about how to stay afloat during the Coronavirus pandemic. The Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) offers some help by providing financial support and tax incentives for small businesses.

If you own a business and you’re trying to figure out which emergency loan to apply for or whether you should apply for both, we can guide you through the process to help you achieve the best outcome.

What types of loans are available?

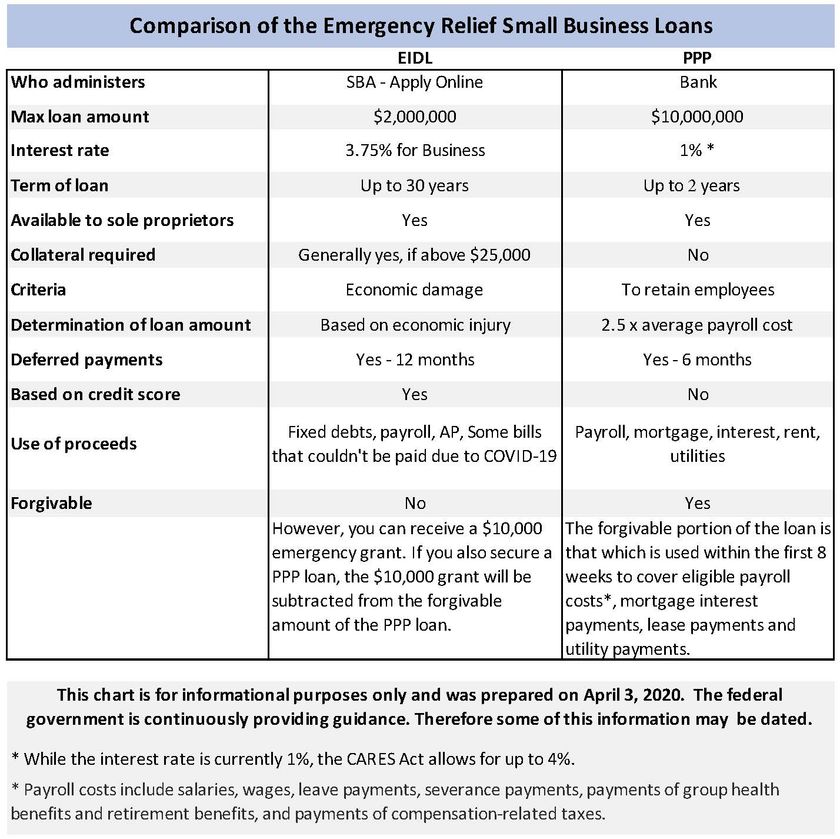

Two of the loans available through the Small Business Administration are the Economic Injury Disaster Loan (EIDL) and the Paycheck Protection Program (PPP).

There is a forgiveness structure that can effectively turn a portion of the PPP loan into a grant and you may be eligible for a $10,000 emergency grant by applying for the EIDL.

It is important to determine which loan is right for your business and whether you qualify for both.

We offer a consultation service that covers the following:

• Business Assessment

• Loan Strategy Discussion

• Review Required Document Checklist

• Business Documentation Review

• Loan Application Review

There is a limited time to apply for these loans. Call us today to schedule your consultation.

864-335-9909

Who Qualifies?

- A small business with fewer than 500 employees

- A small business that otherwise meets the SBA’s size standard

- A 501(c)(3) with fewer than 500 employees

- An individual who operates as a sole proprietor

- An individual who operates as an independent contractor

- An individual who is self-employed who regularly carries on any trade or business

- A Tribal business concern that meets the SBA size standard

- A 501(c)(19) Veterans Organization that meets the SBA size standard

- In addition, some special rules may make you eligible:

What documentation may you need?

While our firm is awaiting further guidance from the federal government regarding the loan application process, collecting the documents below is a good place to start. Insufficient documentation could delay the loan application. This list may change as more information becomes available.

- 2019 IRS Quarterly 940, 941 or 944 payroll tax reports

- Payroll reports for a twelve-month period (ending on your most recent payroll date), which will show the following information:

- Gross wages for each employee, including officer(s) if paid W-2 wages.

- Paid time off for each employee

- Vacation pay for each employee

- Family medical leave pay for each employee

- State and local taxes assessed on an employee’s compensation

- 21099s for independent contractors for 2019

- Documentation showing total of all health insurance premiums paid by the company owner(s) under a group health plan. Include all employees and the company owners Gross wages for each employee, including officer(s) if paid W-2 wages.

- Document the sum of all retirement plan funding that was paid by the company owner(s) (do not include funding that came from employees out of their paycheck deferrals).

- Include all employees and the company owners.

- Also include 401K plans, Simple IRA, SEP IRA’s.

- Company bylaws or operating agreement

22 Apr, 2020

Small business owners who were shut out of emergency loan programs during the first round of funding will likely have another chance to apply. On Tuesday, the Senate passed a $483 Billion Coronavirus Aid Package to replenish the small-business payroll fund, support hospitals and provide for more testing. The House is expected to vote Thursday. According to the Associated Press , $331 Billion, will go toward the Paycheck Protection Program (PPP), one of the SBA Emergency Loans for small businesses. The initial round of funding ran out last week. Small business owners can apply for the loans themselves online. As long as certain criteria are met, a portion of the PPP loan may be forgiven, effectively turning it into a grant. If you’re a small business owner who wants help with the PPP loan, call Forward-Law to schedule a consultation at 864-335-9909. We can guide you through the process and help you achieve the best outcome. This is a recap of the previous PPP loan program that was provided by the SC Chamber of Commerce on Monday:

864-335-9909

905 Pendleton Street, Greenville, SC 29601, US

Copyright 2019 © Forward Law. All Rights Reserved.